Industrial Buildings Allowance (IBA)

|

The Industrial Buildings Allowance (IBA) was introduced by the government in its 1945 Income Tax Act to boost post-war productivity in industry. The idea was that whatever the capital cost of constructing a manufacturing or processing building (or sometimes purchasing it 'second-hand’), the person holding 'the relevant interest' in the building would receive tax relief.

Aimed originally at productive industry, the scope of IBA was broadened to include allowances on infrastructure such as tunnels, bridges, roads used for highway concessions, qualifying hotels and commercial buildings in enterprise zones.

In effect, IBA was a writing down allowance (WDA) – allowing relevant business people to deduct a percentage of the value of an item from their profits each year, which in turn meant they paid less tax – typically for around 25 years, sometimes less. Thus, IBA constituted an incentive to build ‘industrial’ facilities.

However, the item had to count as ‘qualifying expenditure’ that had been incurred on a building.

IBA was made to the person holding relevant interest in relation to the qualifying expenditure. The relevant interest is defined by the construction expenditure incurred on the building; relevant interest therefore is the interest in the building to which the person who incurred the construction expenditure was entitled to when the expenditure was incurred. A building may have had several relevant interests, as construction expenditure could have been incurred at different times and by different people.

The following is an example of relevant interest given by UK tax collection service Her Majesty’s Revenue and Customs (HMRC, formerly ‘Inland Revenue’ for income tax collection):

"Warren builds a factory on land that he owns. The relevant interest for the factory is the freehold interest. If Warren leases the factory to Lowell and Lowell builds an extension, the relevant interest for the extension is Lowell’s leasehold interest. So, there are two relevant interests for the factory – Warren’s freehold interest for the factory and Lowell’s leasehold interest for the extension."

Buildings or constructions that qualified were:

- Buildings of a qualifying trade: e.g manufacturing/processing, storage, generating/transforming/converting, transmitting electrical energy

- Supplying water for public consumption

- Providing sewage undertakings

- Transport, inland navigation and dock undertakings (dock, wharf, pier etc)

- Tunnels

- Bridges (only if expenditure incurred after end 1956-57)

- Highways

- Undertakings for the supply of hydraulic power.

IBA allowances no longer exist. They were continuously in force from 1945 to 2008, after which they became the subject of a phased withdrawal until the financial year beginning April 1, 2011. Since then there have been no IBA writing down allowances.

[edit] Related articles on Designing Buildings

Featured articles and news

Wellbeing in Buildings TG 10/2025

BSRIA topic guide updates.

With brief background and WELL v2™.

From studies, to books to a new project, with founder Emma Walshaw.

Types of drawings for building design

Still one of the most popular articles the A-Z of drawings.

Who, or What Does the Building Safety Act Apply To?

From compliance to competence in brief.

The remarkable story of a Highland architect.

Commissioning Responsibilities Framework BG 88/2025

BSRIA guidance on establishing clear roles and responsibilities for commissioning tasks.

An architectural movement to love or hate.

Don’t take British stone for granted

It won’t survive on supplying the heritage sector alone.

The Constructing Excellence Value Toolkit

Driving value-based decision making in construction.

Meet CIOB event in Northern Ireland

Inspiring the next generation of construction talent.

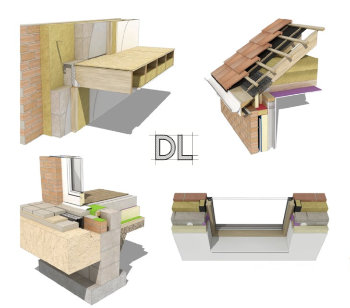

Reasons for using MVHR systems

6 reasons for a whole-house approach to ventilation.

Supplementary Planning Documents, a reminder

As used by the City of London to introduce a Retrofit first policy.

The what, how, why and when of deposit return schemes

Circular economy steps for plastic bottles and cans in England and Northern Ireland draws.

Join forces and share Building Safety knowledge in 2025

Why and how to contribute to the Building Safety Wiki.

Reporting on Payment Practices and Performance Regs

Approved amendment coming into effect 1 March 2025.